The dilemma while choosing the better option between Debt Mutual Funds and typical bank deposits are pretty common. Hopefully, at the end of this article, the ambiguity will be resolved.

How much time do we spend researching our next holiday destination?

And what about buying our next mobile phone? Or even shopping for grocery online?

-Quite a lot, actually!

How much time do we invest in our money ?

Bit by bit, the list grows longer before we realize that most of this information would be of no use in less than a year’s time and we would have to do the drill all over again. Yet, when it comes to our hard-earned money, we are less demanding. Vast sums still lie in savings accounts and fixed deposits (FDs), where it earns little more than a “Privileged” name-tag on cheque leaves, which very few of us use any way.

In the meantime, inflation eats into money. Deposits at bank accounts do earn interest but inflation claws it back mostly. As a result, money buys less today than what it did a year ago. Also, for someone below the age of 60, the interest earned gets taxed as per her rate of taxation, if it exceeds Rs. 10000. While some banks pay higher interest to their depositors, a headlong shift merely to earn attractive deposit rates could badly backfire.

In the world of finance, there is no such thing as a free lunch. Often, higher rates to depositors mean higher interest rates for loans and sometimes that leads to a higher percentage of defaults. Until now, the Reserve Bank of India (RBI) has stepped in to preempt bank failures, but in the event they don’t, the maximum that an investor could end up with is Rs. 5 lakhs under the Deposit Insurance Guarantee. Even if you were prudent enough to spread your risks and make sure that your deposits were under that threshold, it could take many, many years to touch the money, as the process of winding up tends to be painfully long.

Relying solely on bank interest as a means of income is not a very sound strategy and the warning signs had been flashing for quite some time. The Bank of Japan has been pursuing a Zero Interest Rate Policy for decades now and Central Banks across the world have cut interest rates to fuel demand. India too has been no exception and very recently, customers of the State Bank of India saw interest rates on their savings accounts plunge to 2.75 %, leaving them cruelly shortchanged.

Conversely, there is another universe where declining interest rates also create profits, provided one is ready to embrace the risks. In this case, it means having to forego the promise of an assured return.

Debt Mutual Funds

Debt mutual funds do not offer any assured return to the investor, even though they invest in Fixed Income instruments viz. Government securities & Company Deposits, collectively called Bonds for the rest of this piece. Bonds are bought and sold in the Debt Markets and unlike FDs, their ownership changes hands frequently. Retail investors often do not have access to these transactions as they are largely wholesale and Debt Mutual Funds are perhaps their only ticket to this trade. Bonds earn mostly through accrual, also known as the coupon which is the interest paid periodically to the investor. Fund Managers use these accruals as a steady stream of income for their portfolio and earn additional profits by way of capital gains.

Fig-1: Debt mutual funds or fixed deposits; different factors

How do the Bonds work?

To understand how it works, let us imagine the popular Indian dish – the dosa. Some dosas are thin and crisp, while others are thick. However, all dosas need to have the crepe – the dosa doesn’t exist otherwise. In the case of Bonds, it is the coupon that represents the dosa crepe: some have higher coupons, others lower. Investors buy into a Bond with an eye on the coupons and then they enjoy the masala, wrapped inside the dosa and it is known as the capital gains.

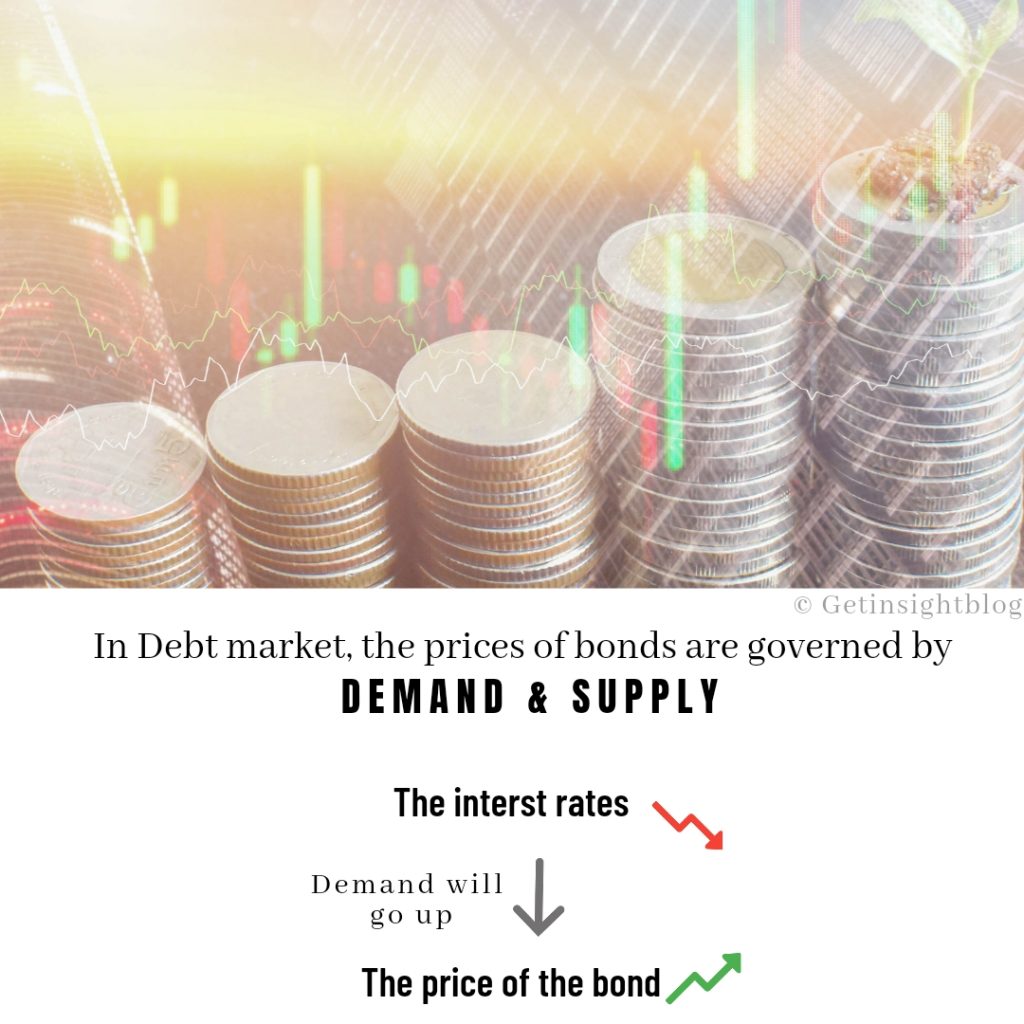

In the Debt Markets, the prices of Bonds are governed by demand and supply. If the buyers expect that the interest rate might be lower in the future, the demand for the available interest rate of today shall rise. As a result, the prices of the existing Bonds would go up and investors would earn capital gains.

The price of a Bond, therefore, shares an inverse relationship with interest rates. Picture a see-saw – on one end of which is Bond price, while at the other end is the interest rate. When the interest rate end of the see-saw drops, the price end of the see-saw rises and vice versa.

Mutual Funds study macroeconomic factors, like-Inflation, GDP growth, money supply, Rupee vs. Dollar graphs: each of which influence the movement of Interest Rates. Fund Managers align their investments based on their Interest Rate predictions and it is this information which makes a well-managed portfolio pull ahead, while others fall behind.

What happens when Interest Rates rise?

It reverses the capital gains to some extent and returns could even turn negative for a while. However, some of the Bonds held by the Mutual Funds would mature during the high Interest Rate window and as they get reinvested, they fetch higher accruals for the portfolio and the investments recover after sometime.

When it comes to investing, categories like- liquid funds stick to very short-term debt instruments and here the market-driven volatility is almost zero. In a way, they are the equivalent of a savings bank account. Other categories, like-ultra-short term funds and low-duration funds invest in slightly longer term instruments and parking some of your money in these funds is a smart way of boosting your returns.

A FD is a contract between the Bank and the account holder, where premature liquidation incurs severe interest rate deductions. In contrast, Debt Mutual Funds manage investments which are held in pools and hence the economies of scale come into play. One can, therefore, choose to invest in funds where the maturities are a little longer than the targeted investment horizon and earn higher returns. However, it is important not to overplay your hand as an interest rate hike could catch you on the wrong foot and the returns could get docked all of a sudden.

Short term funds invest in Bonds of even longer maturities and are ideal for periods which could stretch beyond a year and more. You also have banking & PSU (Public Sector Undertaking) Funds which could work as a substitute for FDs. Fund Managers construct these portfolios by investing in Banks & PSUs where risks of default by the issuer is very remote. These are Companies which have high credit Ratings, which is basically a measure of their ability to repay their financial obligations.

Companies which approach the Debt Markets for funding are assigned Credit Ratings. A top notch Credit Rating means that the Company is solvent and therefore it can comfortably raise its required sum at a very low cost of borrowing.

A compromised Credit Rating however means that the Company would find it very hard to find Lenders and even if it does, they would only demand higher compensation which would push up its cost of borrowing. Cashflows of such businesses could snap in an adverse economic cycle and the prospects of such companies could hit rock bottom. Worse would follow if existing Lenders call in their Debts. Bankers are known to be fair-weather friends and Mark Twain did nail it when he said “A banker is a fellow who lends you his umbrella when the sun is shining and wants it back the minute it starts to rain.” Investors would shun Bonds issued by such a company and their prices would fall sharply in the Debt Markets. Mutual Funds which hold such Bonds would immediately mark down its value and this could hurt portfolio returns very badly. However, if the company is able to pay off its debt, the Mutual Fund would write back its value and the returns would surge back.

Corporate Bond Funds invest in Bonds of Corporates of sound credit ratings. Investors could build their portfolios with some investments in these funds and hold them for 3 years or more. Incidentally, Tax efficiency in the form of indexation is available in Corporate Bond Funds and not if you invest directly in these Corporate Bonds.

Why do the Debt Mutual Funds score over than a Fixed Deposit?

The Taxation aspect is like the chutney which makes the Dosa taste even better.

There are two ways by which Debt Mutual Funds score over than FD and these are viz. Tax deferment and Tax arbitrage.

1. Tax deferment :

It postpones the incidence of taxes on accruals. This facility is not available to investors in FDs as Interest becomes taxable upon accrual every year and even for those opting for cumulative mode of interest calculation, the taxation kicks in. On the contrary, Mutual Fund investors earn Capital Gains, which become taxable only upon redemption. So, the untaxed gain remains in the portfolio and grows through the power of compounding.

2. Tax arbitrage:

This enables investors to profit from favorable taxation treatment, provided their Capital Gains are Long Term in nature. Long Term implies a period of investment which is 3 years or more. Here the investment amount is allowed to be increased to factor in inflation and this reduces the taxable gain in the Investor’s hands. Also the rate of taxation @ 20% is lower for those in the highest income tax bracket and this is a further incentive. FD investors miss out on this as well, even though they often stay invested well beyond 3 years.

Investors who are confident of their risk-taking abilities could also consider Gilt Funds which invest in Government securities. A caveat though – the prices of Government securities, which mature decades later, can go up or down drastically due to a fraction of a percentage change in the Interest Rates. Therefore rising Interest Rates could seriously deflate these portfolios and investors should take their decisions, keeping that in mind.

Last but not the least, there are Credit Risk Funds which invest in Bonds with credit ratings that are below the highest grade. While they indeed offer high returns to potential investors, they also carry the risks of a credit ratings downgrade. In extreme cases, Fund Managers might be forced to segregate the downgraded Bonds. This would mean that parts of the investment would not be available for redemption and the experience could be quite harrowing for the investors. Even withdrawals might be frozen altogether from certain schemes and that would be as much of a nightmare as a moratorium on a bank account. The only comfort that an investor can have is that Fund Managers hold co-laterals which could be sold at an opportune time and price, and thus accelerate the process of recovery.

So why invest in Debt Mutual Funds?

The most compelling reason of course is -Asset Allocation. Equities as an asset class have the potential to deliver double digit returns but they are also volatile. Bonds on the other hand, offer a lower rate of return with less volatility. By having both in the portfolio, the investor protects her corpus from eroding sharply, even if the stock markets crash. Simultaneously, adequate near-cash assets, like-liquid funds help the investor ride out any looming financial crunch and the portfolio prospers as a whole.

In capital markets, winners rotate. The champions of today can become the laggards tomorrow. Diversification happens to be the investor’s best friend in such a situation and Debt Mutual Funds act as a shock-absorber in a portfolio with tax-efficiency thrown in.

Plotting Interest Rate trends as also tracking the Credit Rating universe is a full time job and Mutual Funds have dedicated research teams doing it. Retail investors would find it hard to manage either of these on their own and therefore, have much to gain from the expertise of Debt Mutual Funds in this field.

Further reading

Please read our article on Mutual Funds to learn more about the basic concepts.

The author is a Mutual Funds Distributor & can be reached at sougata.mitra@gmail.com or at 9830772622 for any investment related suggestions.

Very well written and very insightful.

Thank u so much Mr. Sulaiman for your encouraging words

Nice write up – informative & transparent! With the equity markets trading at all time high, it is likely to flat out soon if not come down. The inclusion of Debt MFs become critical in such a situation to balance the portfolio. Thanks for being insightful. Well done!

Thank u so much Amlanda for your encouragement and critical appreciation

Very good article .. worth reading..

Thank u so much Sudip for your appreciation

Informative and well written article.

Thank you for this valuable insight. It is a very good article.

Really well articulated and explained. Especially liked the dosa analogy. 🙂

Look forward to more!