By Sougata Mitra

Money never sleeps. In capable hands, it grows and creates wealth that could last generations. However, if left idle, it shrinks due to a phenomenon called inflation which eats into the purchasing power of money every day, making us pay more and more for fuel, food and the finer things in life. While shopping smart could absorb the impact of price escalation for a few items, the expenses are often non-negotiable when it comes to the Big 3 of modern day living – housing, healthcare and higher education. Savings of a lifetime have often fallen short of the tall bills raised in some instances.

Thankfully there is good news for savers. Especially, for those who are willing to take risks. The restless Goddess of wealth never sits still and if put to work, she has been known to reward the risk-takers. There is however a catch and that is where the factor of volatility comes in – which essentially means that if you are sailing on the high seas, you must be prepared to face stormy weather. Take the recent outbreak of Covid-19 and the subsequent lockdown, for example. Doomsayers have been predicting some kind of a holocaust since the morbid days of March but the fact remains that the reality is not that scary. Already some parts of the world have emerged from this ordeal very creditably and more are likely to follow suit. Time and again, the resilience of the human race has reasserted itself through many challenges and this is only the latest in a very long list.

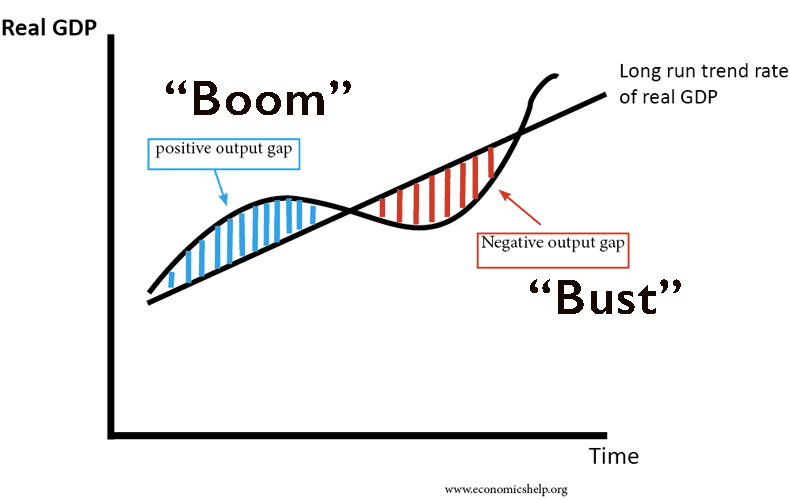

Similarly, economic cycles go through periods of boom and bust. Companies grow staggeringly in certain phases and perform poorly in some others. Governments change policies, regulations and tax structures. However, if there is one constant theme that recurs is that even in such an environment of uncertainty, opportunities are always available.

The Information Technology industry in India established its global footprint thanks to a problem called Y2K, which today very few people remember. Non-Banking Finance Companies (NBFCs) saw spectacular growth in a period when banks were swamped with bad loans. Pharmaceutical companies made medicines affordable and reached out to overseas markets, earlier dominated only by giant Multinationals.

In all of these, there was an entrepreneur who was willing to take risks. Behind him/her, stood millions of investors who bought into the vision and brought their hard earned money on the table. By doing so, they let their investments work as hard as they did in their respective fields and possibly smarter. After all, businesses are considered to be better users of capital than average households and those with strong brands, robust corporate governance and competent management teams rewarded their investors handsomely, over the years.

Mutual Funds enable you to do just that.

The basic difference being there are professional managers who take investment decisions on behalf of the investors whose individual contributions are pooled together in a much larger corpus, which result in significant economies of scale. The costs of research and fund manager’s fees are thus set off against the total funds and turn out to be actually quite reasonable. Fund managers also take a dispassionate view of the investments held in a portfolio. In other words, they are less likely to be swayed by the twin emotions of greed and fear which play on the investors’ minds, often leading to costly mistakes.

Besides, they reduce the risks in a portfolio by way of diversification. In doing this, they follow the golden rule of NOT putting all your eggs in one basket. This remains the single most compelling reason of investing through a Mutual Fund. The universe of stocks tracked by a Fund management team is much bigger than what an individual investor can aspire for and sometimes value lurks in companies which might have slipped under the radar of the keenest of observers.

Categorization of Mutual Fund Companies

Mutual Funds invest as per the categorization of companies specified by the regulator, SEBI. Often these are classified based on their market capitalization also known as market cap which is derived by multiplying the price of share with the number of shares outstanding. There are 3 broader categories of companies viz. large-cap, mid-cap and small-cap. Mutual Funds construct their portfolios by holding such stocks in various proportions based on their investment mandate.

Large-caps: For someone just dipping their toes in the unpredictable waters of the stock markets, large cap companies are an obvious starting point. These are companies that command market leadership and are expected to grow their turnover and profits consistently across business cycles. The demand for the shares of these companies makes them extremely liquid, which means buyers are available at any point in time and thus the prices of these shares tend to fluctuate less compared to the broader markets. These companies lend stability to a portfolio.

Mid-caps: However, for those willing to take risks, greater headroom for growth could be found in the far more volatile midcaps. These companies have the potential to become the leaders in their field and being hungry for growth, they explore segments and products, possibly overlooked by the larger players. Shareholders have reaped considerable gains simply by staying invested in such companies, seeing the value of their holdings multiply over long periods of time.

Small-caps: At the extreme end of the risk-return continuum lie the small cap companies. These are the hidden gems of the markets, waiting to be discovered by the sharp eyed stock-picker. The petrochemical powerhouse of today, which has ventured into telecom and retail was one such company 40 years back, as was the largest private sector bank of the country, 20 years ago. A word of caution, though – for every such success story there are legions of others which have struggled to survive and have winded up abruptly, leaving behind a trail of destroyed shareholder wealth and shaken investor confidence.

Therefore, unless one is ready to get into the nitty-gritty of studying balance sheets and cash flow statements, Mutual Funds offer a low cost solution for investing in the stock markets through professional fund managers and dedicated research teams. Nevertheless, the risks remain and no amount of diversification can remove them entirely. Stock markets are extremely volatile in the short term and even the rewards – as and when they unfold – happen in a non-linear fashion. It is only after years of investing that the value is unlocked and those who do not have the patience end up with below par returns.

Fortunately, there is one way to mitigate the risks and that is through the route of Systematic Investment Plans (SIPs). You could start by investing as low as Rs. 500 per month in a scheme of your choice and it is this discipline which enables you to accumulate more Mutual Fund units when the markets are down. As the years go by, the markets recover and the value of the portfolio goes up significantly. This works best for meeting life goal expenses like paying for higher education and retirement planning.

In conclusion – with interest rates nosediving, there is a strong case for looking at other ways of earning higher returns. Stock markets are indeed an option but for the beginner, it makes sense to let an expert handle the process and Mutual Funds are ideally placed to do that job.

The author is a Mutual Funds Distributor and can be reached at sougata.mitra@gmail.com or 9830772622

Copyright 2020, GetInsight.blog

Disclaimer: The present article is a guest column. Views expressed are personal.

Excellent articulation by Sougata Mitra about calculated and cautious Financial Planning. The author displayed his deep and balanced knowledge about the realm of investments and deep dangers of not investing. This is an immensely helpful read by any investor – rookie or pro. Keep writing Sougata!!

Gr8 blog sougata ji. Very insightful going by the change in investment pattern of intelligent investors. Diversification is key within or across asset class, very well get captured through mutual funds. Keep sharing your insight and I am sure investors will get benefitted out of it. Many thanks.

Very good write up by Sougato Mitra. This will particularly be helpful for those who wish to get an idea of the overall scenario. Congrats and please keep it up by writing more on the pros &cons, opportunities & risks of Equity MF, Debt MF.

Very well articulated

Very good write up by Sougato Mitra. This will particularly be helpful for those who wish to get an idea of the overall scenario. Congrats and please keep it up by writing more on the pros &cons, opportunities & risks of Equity MF, Debt MF.

Very good write up by Sougato Mitra.

Everything is very open with a very clear clarification of the challenges. It was definitely informative. Your site is useful. Many thanks for sharing! Lari Chariot Gillian

Excellent analysis… This will give an overall idea about mutual fund to the person who has no idea about it.